|

|

Retail Update - November 2018 |

| |

Posted At: 15 November 2018 16:54 PM

Related Categories: Future of Retailing, General, Retailers, Store Closures |

| |

Continuing the pattern of the year, and starting to sound like a broken record, the retail world is still rather gloomy.

The high street continues to suffer retail losses; bakery chain Peyton & Byrne, Evans Cycles and listed butcher Crawshaws Group all fell into administration but have subsequently been rescued. This week alone has seen the demise of 50-year old bridal chain Berketex Brides, which fell into administration with the immediate closure of its stores. Almost 1,000 retail businesses fell into administration in the year to September 2018, the highest number in five years.

As many as 85,000 jobs have disappeared from the UK high street so far in 2018, according to figures from the Office for National Statistics. The first six months of the year saw 80,000 jobs lost, with a further 5,000 thought to have been lost between July and October.

However, as autumn gives way to winter and retailers turn their attention to the all-important Christmas trading season, there is some better news to be had;

-

Spending by retailers on Christmas advertising is set to hit a new high of £6.4bn this year [Advertising Association], having risen nearly 50% in eight years

-

London’s New Bond Street has been named as the most expensive retail street by rental value in Europe, new data from Cushman & Wakefield shows

-

UK apparel and footwear spend via online-only retailers is set to soar by 67.4% over the next five years, reaching £7.5bn in 2023 and accounting for over one-third of online clothing and footwear sales by 2023, a new report by GlobalData claims

-

The number of independent retailers in the UK is forecast to creep up 0.3% by 2023, surviving because they can be more nimble than big businesses in the face of change, according to the research by American Express and GlobalData

-

Westfield London has been named as the leading UK shopping centre by the Trevor Wood Associates’ shopping centre guide, overtaking Westfield Stratford which has been number one for the last six years

-

Black Friday sales in the UK are expected to reach £1.54bn, with shoppers set to spend 13% more than 2017. Online spend is estimated to total £8.1bn during peak activity between 19-26 November [IMRG]

And finally, October’s Budget revealed a £675m pledge to create a “Future High Streets Fund” to support councils in drawing up plans for the transformation of their High Streets, allowing them to invest in the improvements they need and to facilitate redevelopment of under-used retail and commercial areas into residential.

|

|

|

|

Retail Update - October 2018 |

| |

Posted At: 22 October 2018 14:21 PM

Related Categories: Retailer At Risk, Store Closures |

| |

Continuing the pattern of the year, the retail world is still a bit gloomy.

The high street continues to suffer retail losses; both Orla Kiely and Aspire Style closed their stores and website and Mountain Warehouse took the decision to close its Zakti standalone store format, choosing to rebrand them as it reshuffles its estate. The last week alone has seen Coast fall into administration with the closure of 24 stores and the rest of the business being acquired by Karen Millen. American Golf also entered administration but was immediately bought by private equity investor Endless. Many other retailers teeter on the edge, not helped by a 2.4% increase in inflation which will add an additional £186.45m to retailer’s business rates bill next April.

However, as autumn sets in, there is some better news to be had;

-

Social media platform Pinterest has introduced new shopping pins linking directly to product pages on retailer’s sites. Testing has already shown a 40% monthly increase in clicks to retailers

-

London’s Bond Street has just completed a £60m makeover ahead of the Elizabeth Line opening. The transformation includes a £10m investment into a new streetscape for the area, together with a further £50m being invested into ten new store openings

-

Westfield in Shepherd’s Bush has been dubbed the UK’s best-performing shopping centre in a new report by GlobalData, scoring 4.09 out of five, with Westfield Stratford City coming in second place at 3.98 out of five

-

Westminster City Council has unveiled fresh plans to future-proof the Oxford Circus area. The council plans to set aside £150m for the new Place Strategy and Delivery Plan, which aims to provide major improvements across the shopping district, including Oxford Circus, Marble Arch and Cavendish Square

-

The Coffer Peach Tracker reveals that managed pub sales continued to outshine restaurants after a bumper summer for drinks-based operations. Pub like-for-like sales picked with 1.9% growth in September as wet offerings continued from the momentum of the summer’s heatwave

-

Research by Savills has found that the number of international retail and leisure brands opening their debut UK outposts in London is increasing. To date, 36 new entrants have launched in London since 2018 began, exceeding the full-year total of 32 in 2017. The 2018 total could tally around 45, potentially heralding a 40% increase year-on-year and bringing it closer to the 2016 peak of 53

And finally, new research has shown that contactless payments in UK shops are now more popular than chip and Pin card payments. Payments technology company Worldpay said it was the first time it has seen “tap and go” contactless payments overtake Chip and Pin. The switch-over happened in June, when 51% of in-store card transactions in that month were contactless.

|

|

|

|

Retail Update - March 2016 |

| |

Posted At: 29 March 2016 00:27 AM

Related Categories: Administrations, Retail Statistics, Retailers, Store Closures |

| |

The past month has seen a bit of turmoil on the high street, although no administrations have been recorded on SnapShop.

BHS proposed a CVA at the beginning of March which was subsequently approved this week to enable it to reduce rents in 40 loss-making stores as it looks to continue to trade through its turnaround plan.

Beales also filed for a CVA at the beginning of March for 11 of its 29 stores, seeking a rent reduction of 70% on 11 stores for 10 months while it negotiates with landlords. The other 18 stores – including its flagship in Bournemouth – are unaffected.

Recent weeks have seen plans to extend Sunday trading hours rejected by MPs, meaning that all will stay the way it has been on the high street. Many see this as a victory, while others see it as a disappointment. FSP can see both sides of the coin, and we wonder whether this is something that will be addressed again in the future as we move further into the digital world.

With the news that Google is bringing Adroid Pay to the UK soon, Barclaycard research has shown that contactless spending in 2015 soared by 188% in pubs and bars. The category experienced the third biggest rise in 'touch and go' transactions over the past year behind public transport (532%) and pharmacies (207%). Contactless spending in fast food outlets was also up 108%. Restaurants witnessed a 104% increase and caterers, ranking 10th on the list, saw a 96% uptake in the speedy payment method. This is definitely something to watch in the coming months.

Another addition to the ‘ones to watch’ list, is that a wave of American retailers is predicted to cross the pond and use London as a launch-pad into European expansion. Research from BNP Paribas has forecast that brands such as Michael Kors, America Eagle Outfitters, Henri Bendel and Tory Burch, as well as new market entrants, will be among the US retailers drawing up expansion plans, seeking to capitalise on the buoyant consumer environment in the UK.

|

|

|

|

Retail Update - July 2013 |

| |

Posted At: 18 July 2013 11:15 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Research by Deloitte shows that the number of retail administrations fell by 30% in the first half of 2013, with a reported 87 collapses compared to 124 in the same period last year. Since our update last month, this list now includes:

-

Dwell appointed Duff & Phelps as administrators at the end of June, but was saved by its founder Aamir Ahmad who bought five stores and its online operations at the beginning of July

-

Miss Sixty and Energie stores in the UK are to close after liquidators were appointed to the UK business. The nine closures include Westfield Stratford, Bluewater Shopping Centre and on Covent Garden’s Neal Street

-

Ark fell into administration after June’s rent quarter day but was rescued by JD Sports almost immediately

-

Modelzone appointed Deloitte as administrators. Having received no offers for the business, store closures and further redundancies are being proposed

-

Nicole Farhi appointed Zolfo Cooper as administrators, who have received a large number of expressions of interest for the business

-

Internacionale underwent a pre-pack administration by its former management team and resulted in the immediate closure of 18 stores

-

Homebase has placed its Irish arm into examinership following poor trading in the country, and is proposing to close three of its 15 stores to put the business back on a sustainable footing. KPMG has been appointed as interim examiner which will provide protection for Homebase Ireland

In regeneration news, the third and last significant shopping centre and leisure development scheduled to open this year, has opened its doors. The 473,000sq ft New Square development in West Bromwich finally opened last weekend, after the opening was postponed from spring 2012 to July this year following delays in finalising third-party agreements with the adjacent Queen’s Square development. Primark and Tesco Extra anchor the scheme, other tenants include JD, Next, Arcadia and Bank. Figures show that nearly 100,000 shoppers flocked to the scheme during its first four days of opening.

In other news, the Commons Select Committee has announced that Mary Portas is to face questions by the Communities and Local Government Committee on her recent review into the future of high streets, Portas Pilots, Town Team Partners, and Bill Grimsey’s alternative review of high streets. The Committee also stated that the session with Portas “may inform a wider inquiry into the future of town centres later in the session”.

Following Portas’s review and the continuing demise of the UK’s high streets, alternative options for its future are being offered up. These include not only more engagement between LEPs and councils with their local retailers, but the revamping of historic buildings and more emphasis on the heritage of the local area are pointed out as key drivers of footfall and in attracting retailers. English Heritage points to Rotherham in Yorkshire which has seen a 6% increase in footfall since public funds were used to repair historic buildings. Some leading experts are calling for town centres to be shrunk, with the Government now proposing to turn retail units into housing as they intend to consult on the relaxation of planning regulations which would allow “communities to consolidate high streets”. With the ever increasing number of discount retailers and betting shops opening on our high streets, something – be it one of these proposals or a completely different idea - needs to be done to stop its demise.

|

|

|

|

Retail Spotlight – Dwell ceases trading |

| |

Posted At: 21 June 2013 11:10 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following a cash-flow crisis and failed attempts to find a buyer or secure fresh working capital, Duff & Phelps were appointed as administrator to the furniture chain, Dwell.

SnapShop now brings to you an overview of the retailer’s trading over the years and highlights of the collapse.

To us it looks like a typical case of biting off more than you can chew – in the last two years the retailer opened over 9 new stores and had plans to open around a hundred or so more in the future.

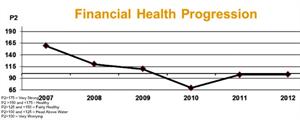

Financial indicator, P2 improved marginally in 2011, but not to the extent of indicating sustainable health, whilst there has been no measurable return on trading assets in the past three financial years. The latest accounts showed an over-reliance on creditors, a shortage of working capital which may have inhibited sales and despite securing a significant level of refinancing, it’s possible that new store openings at high cost locations may have resulted in the final blow.

20th June 13 - Dwell closed all 23 stores and ceased trading both on the High Street and online with immediate effect - resulting in the loss of 300 jobs. Read more

13th June 13 - Dwell insisted that it is continuing to trade as usual, amid speculation that it is on the brink of administration.

7th June 13 - Future of Dwell was close to being decided after appointing Argyll Partners to explore option.

29th May 13 - Dwell appointed Argyll Partners to explore its options, including the possible sale of the business.

28th Feb 13 - The 52 week period ending 27 Jan 12 represented a successful period, with the company generating sales growth of +3.3% to £34.5m. During 2012, the company successfully opened six new stores, increasing the number of stores to 24, and these are already making a positive contribution to the company. The stores were in Guildford, Cardiff, Leeds, Lakeside Thurrock, Staples Corner (North London) and Birmingham (Bullring).

Key:

P2>175 – Very Strong

P2 >150 and <175 - Healthy

P2>125 and <150 – Fairly Healthy

P2>100 and <125 – Head Above Water

P2<100 – Very Worrying

14th Nov 12 - Dwell appointed Rebecca Cotterell as its new managing director, replacing founder Aamir Ahmad who stepped down from the role.

28th Aug 12 - Retailer appointed a Director of Multichannel as it seeks to improve its online offering.

1st June 12 - Dwell saw the scope for up to 100 stores as it looks for smaller, quirkier shops.

13th Dec 11 - Dwell agreed a lease on a store at St David’s shopping centre in Cardiff, which will be its first outlet in Wales.

18th Nov 11 - Dwell has bounced back into the black at an EBITDA level as sales grew in the year to January 28 despite a punishing big-ticket market.

2nd Nov 10 - Dwell signed up at Lend Lease's Touchwood shopping centre in Solihull.

3rd Sept 10 - Dwell set out a 33-store expansion plan after securing a £5m investment from a private equity firm.

SnapShop subscribers can view retailer profile, more historic news, accounts and financial standing over the years, by visiting Retailer Directory here.

To stay up-to-date with retail administrations, new retailer entering UK and news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

|

|

|

|

Retail Spotlight – Pumpkin Patch UK subsidiary goes into administration |

| |

Posted At: 19 January 2012 15:23 PM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following the announcement of collapse of children’s store Pumpkin Patch in the UK; we bring to you an overview of the retailer’s financial performance over the years and highlights of the latest news

19/01/2012 - Pumpkin Patch has called in administrators on its UK subsidiary, this does not affect any other of the group's companies. Retailer said current economic environment in the UK and in wider Europe is extremely difficult. It’s website and social media channels have not been updated with this information

28/09/2011 - The CEO resigned after the company swung to a full-year loss, which it blamed on soaring cotton prices, soft trading conditions, and the impact of natural disasters in the region

11/02/2011 - The results of the company for the year ended 31 July 2010 showed a pre-tax profit before non-recurring items of £1,872,183 for the year and sales of £24,993,241. During the year retailer opened 3 new stores and had expected to open 3 new stores in 2011

8/07/2010 – For the year ended 31 July 2009, the results for the company show a pre-tax loss before non-recurring items of £4,842 (2008 loss of £277,892) for the year and sales of £24,076,404 (2008 £23,731,916).

Financial Health:

Key:

P2>175 – Very Strong

P2 >150 and <175 - Healthy

P2>125 and <150 – Fairly Healthy

P2>100 and <125 – Head Above Water

P2<100 – Very Worrying

To keep a tab on these retail administrations and financial health of over 2000 retailers, please subscribe to SnapShop with membership starting from only £96 pa.

|

|

|

|

Retail Spotlight – D2 Jeans goes into administration |

| |

Posted At: 04 January 2012 10:00 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

The festive period brought a spate of administrations across the high street with D2 jeans failing early in the New Year. We bring to you news highlights and information about the retailer’s performance over the years.

04/01/2010 - Fashion chain D2 became the first post-Christmas retail casualty, falling into administration

11/01/2010 - D2 was bought out of administration by its management team saving 44 stores out of 76 and 500 jobs

3/01/2012 - Store chain D2 Jeans collapsed into administration again, making 200 staff redundant and putting hundreds more jobs at risk. Administrators closed 19 UK stores - including six in Scotland - and laid off shop workers at the Ayrshire-based firm. The Scottish closures were in Clydebank, Falkirk, Glenrothes, Hamilton, Irvine and Paisley. D2's other 28 stores are being run as a going concern while a buyer is sought by administrators, BDO LLP.

As at 3/01/2012, the website has been shut – optimistically stating that it is “temporarily” out of service, whilst displaying the returns policy and list of stores which are trading.

Financial Health

SnapShop uses a well-tested and reliable score based on value added, that is, sales minus the cost of bought-in goods and services, also known as P2.

Key:

P2>175 – Very Strong

P2 >150 and <175 - Healthy

P2>125 and <150 – Fairly Healthy

P2>100 and <125 – Head Above Water

P2<100 – Very Worrying

To view retailers profile and more information on retail administrations for 2011-12 please subscribe to SnapShop.

|

|

|

|

Retail Spotlight – Barratts Priceless plunges into administration |

| |

Posted At: 09 December 2011 14:17 PM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

How cruel that quarter rent day is on Christmas day. When tills should be ringing, for some, there may only be the sound of doors slamming shut, including high street footwear retailer Barratts.

Following the recent news of collapse of Barratts Priceless for the second time, FSP has reviewed and updated the retailer records on SnapShop. Below is a summary of the retailer profile and highlights of the administration:

26/01/2009 - Shoe retailer Stylo's Barratts and Priceless Shoes collapsed into administration

19/02/2009 - The Ziff family rescued 160 Barratts and Priceless shops, , the remaining 220 stores were closed

20/03/2009 - Barratts Priceless appointed property agent CB Richard Ellis to renegotiate terms on the 160 stores it bought out of administration

19/03/2010 - Footwear retailer unveiled a new look for its Oxford Street flagship store

18/05/2010 – Barratts launched its first iPhone App and had plans to roll-out click & collect, targeted SMS marketing and promotions

3/12/2010 - Barratts has appointed John Hood, former managing director of footwear retailer Brantano, to the newly created role of brand director

8/12/2011 - The consolidated results for the 18 month period ending 31st July 2010 showed an operating profit after exceptional items of £8.6m from sales of £218.5m

10/02/2011 - Barratts has increased its email conversion rates after an overhaul of its e-commerce strategy

8/12/2011 – Reduced trading, increasing competition threatened Barratts ability to pay December’s quarterly rent bill, leading to collapse of chain thereby putting 3,840 jobs at risk. Given the gloomy economic backdrop, retail analysts are not confident that a buyer for the chain will be found

From the retailer’s own website, “On December 2011, Daniel Francis Butlers, Neville Barry Kahn and Adrian Peter Berry were appointed Joint Administrators and now manage the affairs, business and property of the Companies in Administration. The Joint Administrators act as agents of the Companies and contract without personal liability. The Joint Administrators are authorised by the Chartered Accountants in England and Wales. All licensed insolvency practitioners of Deloitte LLP are licensed in UK”.

With worsening consumer confidence, the run-up to Christmas is bound to bring more pain for the retail sector - how deep that pain will go? could this be avoided?

SnapShop provides information on 2,000+ retail fascias, including the Barratts fascias: Priceless, Shellys, Bacon Shoes

|

|

|

|

Retail Investigation - Best Buy axes 11 UK stores |

| |

Posted At: 07 November 2011 16:48 PM

Related Categories: Retailers, Store Closures |

| |

Following the recent news about the closure of 11 Best Buy stores the SnapShop team investigates what could have gone wrong? Is the market shrinking or did the concept just not appeal to the target market. Was the retailer thwarted by a global recession or can the failure be attributed to the cultural differences in how people like to shop here in UK or is it to do with the competition from discounters and online rivals?

When Best Buy initially laid plans to expand in UK in 2008, it had aimed to open 80 Best Buy stores across the UK by 2013 – but in the subsequent 3 years, things proved to be very different.

During its first full year of its operation the business lost £62.2m. In June it was reported that the retailer was on the verge of stopping further European expansion due to weak consumer demand and changing shopping habits. Roger Taylor, Carphone Warehouse’s chief executive had estimated that it would cost about £40m to exit property leases on Best Buy UK’s 11 stores. In February 2011, Best Buy closed stores in China and Turkey. It is now exploring ways to reintroduce the brand in China after it failed to get the right connection with the customer.

With decreasing disposable incomes, it seems shoppers have cut spending on discretionary items like electrical goods, but is this the case across the sector? SnapShop information shows a mixed picture:

Dixons Retail reported margins and underlying profit before tax, at £85.3m, maintained for the year ended 30 April 2011. Total underlying group sales down 2% to £8,154.4m (2010 £8,320.0m) and over 80 megastores across the group, including 40 in the UK and 25 in the Nordics were reformatted by peak 2011.

Homebuy achieved a turnover of £24.8m and an operating profit of £974,000 for the year ended 17th September 2011. On the other hand, Ask Electronics sales fell only by 6% for the year ended 30th April 2010, group operating profit fell from £388,925 to £227,088.

For the year ended 3rd July 2010, Superfi turnover fell by 1.2% and the company recorded an operating profit of £21,509 (2009 £152,043).

Anthony Chukumba, an analyst with BB&T Capital Markets said that Best Buy has made mistakes, by announcing its expansion plans so openly giving rivals the opportunity to respond. Dixons opened a series of megastores by combining its existing Currys and PC World outlets not only imitating Best Buy's strategies but often targeting similar locations, said the analyst.

The store closures puts 1,100 store jobs at risk, but the firm said it hoped to find the "large majority" alternative work. The closure of the Best Buy shops is not expected to bring to an end the Best Buy tie-up and it is expected that Best Buy will continue to supply gadgets to be sold in Carphone Warehouse shops.

For more up to date news, analysis and statistics on Best Buy and over 2000 UK retailers, please subscribe to SnapShop - or signup to receive SnapShop Monthly for free for three months by signing up for FreeZone here.

|

|

|

|

Retail Spotlight – Walmsley sinks into administration |

| |

Posted At: 02 September 2011 15:00 PM

Related Categories: Administrations, Retail, Store Closures |

| |

Following the collapse of Walmsey Furnishings; we bring to you an overview of the retailer’s trading over the years and highlights of the administration.

01/09/11 - Furniture chain Walmsley has become the latest casualty of the consumer spending downturn after collapsing into administration. Out of 60, 25 stores have already been sold to a new owner (private equity firm SKG) by administrators from Leonard Curtis. The rest have been closed, but uncertainty surrounds the future of 200 staff. There is no information about administration on their website, which just features 25 stores, as opposed to 60.

Store Closures Summary

|

Region

|

Store Closure Count

|

Store Locations

|

|

North West

|

8

|

Ashton, Blackburn, Burnley, Farnworth, Kirkby, Preston, Runcorn and Skelmersdale

|

|

Midlands & Wales

|

9

|

Bangor, Coventry, Derby, Dudley, Erdington, Hereford, Stafford, Walsall and Wrexham

|

|

North East & Yorkshire

|

11

|

Castleford, Grimsby, Halifax, Hartlepool, Huddersfield, Hull, Middlesbrough, Rotherham, Scunthorpe, Sheffield and Worksop

|

|

Scotland

|

5

|

Airdrie, Dalkeith, Dundee, Irvine and Paisley

|

|

Other

|

5

|

Basildon, Bedminster, Bracknell, Sittingbourne and Weston

|

08/02/11 - For the year ended 30th April 2010, the company operated through 65 stores. It reported a difficult year with decrease in sales and the profit for the year amounted to £158,910

26/04/10 - The Company was accused of selling sofas that left people with rashes and burns

27/01/10 - During the year ended 30th April 2009, the company traded from 69 stores in England, Wales and Scotland. Two new stores have been opened during the year and one has been relocated. The profit for the year, after taxation, amounted to £216,425

To find more information and view retailers profile on Walmsley’s and many other retailers, you can subscribe to SnapShop with membership starting from only £96 pa.

We will be updating this blog as we receive information on store closures, redundancies, acquisitions etc., so if you wish to stay informed about Walmsley furnishings please fill in your email address in the subscribe box to the right of the SnapShop Blog screen.

|

|

|

|

Retail Spotlight - Floors-2-Go crashes again with 192 job losses |

| |

Posted At: 25 August 2011 14:57 PM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following the collapse of Floors 2 Go; we bring to you an overview of the retailer’s trading over the years and highlights of the administration

25/08/11 – 35 out of 88 stores have been bought by Nixon & Hope – which was formed this month by former Floors-2-Go directors Parjinder Sangha and David Vizor

24/08/11 - Specialist retailer Floors 2 Go was put into administration. 53 stores have been closed with the loss of almost 200 jobs. It blamed increasing competition, internet sales, lack of disposable income from consumers and primarily general downturn over the last 12 months to be the reasons for collapse

14/01/11 – Retailer hired former B&Q chief Jim Hodkinson as chairman and won £3.25m cash injection from Hotbed with plans to open 60 stores in 2011. Floors-2-Go director Michael Coleman said the retailer was trading "very comfortably" but remained cautious about 2011

30/05/11 – Jim Hodkinson’s appointment as chairman terminated

04/06/11 - Floors-2-Go and Topps Tiles in dispute over email allegations about Floors-2-Go’s performance

27/05/10 – Financial Performance for the year ended 31 July 2009 - the year to July 2009 saw a profit of £853k on sales of £34m and an impressive 9% growth in LFL sales (comparing same stores trading in either Floor My Home Ltd or the previous Floors 2 Go Ltd business)

27/10/2009 – Following pre-pack administration in 2008, retailer’s management was thought to be looking for commitments from interested parties to invest should its trading continue to prosper

Floors 2 Go - Retail Profile

Established in 1999, Floors 2 Go is a nationwide chain of privately owned and operated retail showrooms that offer a selection of the latest styles in carpet, hardwood, laminate, tile, area rugs, vinyl and window fashions, aimed at the Middle price sector.

It has had a troubled history, first entering administration in August 2008. It was later rescued by founders Michael Coleman and Robert and Richard Hodges. Hodges duo bought 80 out of 132 stores, who also run competitor brand named Floor My Home - rebranded all their other stores to the Floors-2-Go fascia.

In August 2011, retailer collapsed into administration again, closing 53 stores with the loss of almost 200 jobs. However 35 shops are still trading by the sale of part of Floors 2 Go to specially formed acquisition vehicle Nixon & Hope. Senate Recovery have been appointed as administrators.

Floors 2 Go transactional website, is still operational with no mention of change of ownership.

For more information on retailer’s financial health, please subscribe to SnapShop or signup to receive SnapShop Monthly for free for three months by signing up for FreeZone here.

|

|

|

|

Retail Spotlight – TJ Hughes store closures- Updated |

| |

Posted At: 12 August 2011 00:24 AM

Related Categories: Administrations, Retail, Store Closures |

| |

Following the collapse of TJ Hughes; we bring to you: update on store closures and highlights of the administration

• 11/08/11 – TJ Hughes closed its Salford store after looters vandalised property and stole goods and TJ Hughes in Middlesbrough, Preston, Southend, Bristol, Kings Lynn, Newport, Ipswich and Maidstone will also all shut down between August 16th and 18th, resulting in the loss of 474 jobs • 11/08/11 – TJ Hughes closed its Salford store after looters vandalised property and stole goods and TJ Hughes in Middlesbrough, Preston, Southend, Bristol, Kings Lynn, Newport, Ipswich and Maidstone will also all shut down between August 16th and 18th, resulting in the loss of 474 jobs

• 10/08/11 - Some 134 retail jobs were secured after the administrators announced that they have sold another two of the company’s stores (Widnes & Newcastle) to Lewis’s Home Retail

• 04/08/11 – TJ Hughes will close 22 stores by the end of 14th August resulting in the loss of 1,061 jobs

|

Store Locations |

Last day of trading |

|

Shrewsbury |

August 10th 2011 |

|

Birkenhead, Dumfries, Dundee, Rochdale, Widnes, Wolverhampton |

August 11th 2011 |

|

Stretford |

August 13th 2011 |

|

Bolton, Boscombe, Burnley, Chester, Crawley, Hull, Kettering, Kidderminster, Macclesfield, Nuneaton, St Helens, Walsall, Watford, Weston-super-Mare |

August 14th 2011 |

• 01/08/11 – 4 stores sold to Lewis's Home Retail including flagship store in London Road, Liverpool, together with stores in Eastbourne, Glasgow and Sheffield

• 22/07/11 - Around 100 TJ Hughes employees were made redundant after a shock announcement that the retailer’s distribution centre in Liverpool is to close

• 07/07/11 - Administrators E&Y of collapsed retailer TJ Hughes said that it was encouraged by the strong level of interest in the retail business and its stores

• 06/07/11 – Retailer called in liquidator to sell off the stock

• 30/06/11 - TJ Hughes collapsed into administration - Sir Philip Green, Primark and B&M Bargains expressed interest in stores

• 28/06/11 - TJ Hughes filed an intention to appoint an administrator

• 28/04/11 - The retailer's chief executive Beatrice Lafon was replaced after 3 months by Bob Lister

• 21/04/11 - Anthony Solomon, who together with turnaround investor Endless invested an unknown amount in the business for a significant stake

• 15/04/11 – Endless appointed Anthony Solomon as executive chairman

• 01/04/11 – New owner, Endless made efforts to put the value department store group on a firmer financial footing

• 25/03/11 – Discount department store was refinanced and sold to restructuring specialists Endless

• 11/03/11 – Retailer refinanced using an asset based facility giving it access to working capital

• 17/11/10 - During the 52 week period ended 30 January 2010 total sales increased by £5.4m to £266.7m. Gross profit increased by £5.0m with gross profit percentage rising from 36.5% to 37.6%

• 12/11/10 - TJ Hughes has named Beatrice Lafon as its new chief executive

• 07/06/10 – Department store chain pulls sale process

• 16/04/10 - TJ Hughes put up for sale with a £70m price tag

• 21/11/09 – Retailer opens new store in Walsall

• 09/11/09 – Discount chain TJ Hughes appointed bankers Hawkpoint to advise on options including a possible sale

As at 11th August 2011 retailer’s website is operational with a closing down sale and says ”…The affairs, business and property of TJ Hughes Limited (In Administration) are being managed by the Joint Administrators, S Allport and T A Jack who act as agents of TJ Hughes Limited (In Administration) only and without personal liability”

For more information, please subscribe to SnapShop or signup to receive SnapShop Monthly for free for three months by signing up for FreeZone

|

|

|

|

Retail Insolvencies in Q2 2011 |

| |

Posted At: 28 July 2011 15:00 PM

Related Categories: Administrations, Retail Statistics, Retailers, Store Closures |

| |

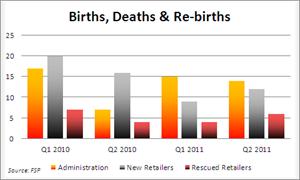

According to recent report by PwC, the number of UK Company insolvencies fell in the second quarter but warned that corporate failures could rise in some sectors as consumer spending remains weak.

In total, 3,531 UK companies became insolvent in the second quarter, a 16% decline from the 4,216 failures in the first three months of the year, according to an analysis by PwC.

Some of the administrations noted on SnapShop for first half of 2011 were long-established high street chains such as Oddbins, Moben, Dolphin, Focus DIY, Habitat and Jane Norman, as well as some newer names like Georgina Goodman and Life & Style. Over the previous quarter, the number of retail administrations has gone down by 7% in second quarter of 2011 compared to first quarter of 2011 - a significant number of them were household names.

At the same time it was interesting to know that number of new retailers entering UK have increased by nearly 33% in Q2 2011compared to Q1 2011 along with an increase in number of retailers rescued in Q2 2011 compared to that in Q1 2011.

We were asked, if this is because landlords are working harder to help retailers? Well, yes and no. Landlords are well aware there aren’t too many retailers knocking on their doors. And some rent is often better than nothing also as Q2 takes in the period after the retail doldrums of February and March. Retailers having survived Q1, hope for better times. But Midsummer Quarter Day, rent day for the Third Quarter, is a day of reckoning.

Alongside this there was an affirmative research published by LDC showing no change from the occupancy level seen at the beginning of 2011, LDC suggests this is due to regional variations and a high volume of betting shops, supermarkets and charity shops opening across the country, and it also points to an improvement in the opening of independent stores.

Do you need to keep up-to-date with these trends and statistics? Please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

|

|

|

|

Retail Spotlight - Moben, Sharps and Dolphin owner collapses into administration |

| |

Posted At: 27 June 2011 15:39 PM

Related Categories: Administrations, Retail, Store Closures |

| |

On 22nd June 2011 – Retailer launched a new ad campaign uniting its three brands for the first time. Brands will all feature the same '& You' branding in the new campaign that will communicate the group's half-price sale

On 23rd June 2011 - Homeform has filed a notice to appoint an administrator. Advisers were appointed to sell bathroom retailers Moben and Dolphin in a bid to save its Sharps and Kitchen Direct businesses

On 27th June 2011 – HomeForm collapsed into administration, putting 1,300 jobs at risk

History of Events

October 2002 - The Homeform Group, which operates Moben Kitchens, Kitchens Direct, Sharps Bedrooms and Dolphin Bathrooms introduced a new store format that brings its various brands together within a single store

March 2009 - HomeForm launched its biggest ever in-store spring marketing campaign for its three brands

May 2009 - HomeForm opened concessions in four Bhs Home stores

June 2010 – Group chief executive Tony Vicente and chief financial officer Tim Kowalski left the business amid a difference of opinion with the owners

Oct 2010 - Retailer's new chief executive (Chris Palvlosky) laid out his three-year plan to increase profits and enable an exit for owner Sun European Partners. Looking for a way to contact retailers? please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

Retailer’s Financial Health (Year Ended 28th March 2010) – HomeForm Group

Turnover in the 52 week period of trading was £151.2m (2009 £148.2m). The loss before tax was £6.0m (2009 loss £12.m).

During the period, turnover rose by 2% despite the impact of the UK recession. Through increased operational efficiencies and cost cutting, the company's EBITDA was a profit of £1.0m compared with a loss of £3.4m in the prior year.

Retailer Profile – HomeForm Group

The HomeForm Group is the UK's market-leading specialist retailer of fully fitted home improvement products through its key brands Moben (fitted kitchens), Kitchens Direct (fitted kitchens), Sharps (fitted bedrooms) and Dolphin (fitted bathrooms).

The Group's head office is at Cornbrook, Manchester and HomeForm has 160 showrooms across the UK including 83 concessions in Homebase, Bhs, Next and Laura Ashley with over 1300 employees and 1500 self-employed fitters and designers.

The HomeForm Group is private equity owned by an affiliate of Sun Capital Partners Inc.

In the latest accounts filed it was mentioned that the company is confident that as the UK economy improves and further cost savings and efficiencies are implemented, the business will be well placed to realise improved results. However, it was announced in June 2011 that Homeform Group has entered administration. It is hoped that it will be able to sell off its Moben and Dolphin brands in a bid to save its Sharps and Kitchens Direct businesses.

|

|

|

|

Retail Spotlight – Jane Norman goes into administration |

| |

Posted At: 27 June 2011 15:28 PM

Related Categories: Administrations, Jane Norman, Retail, Store Closures, Womenswear Retailer |

| |

Following the recent news that the womenswear retailer Jane Norman has collapsed into administration; we reviewed and updated the retailer record on SnapShop. Below is a summary of the retailer profile and highlights of the administration:

On 27th June 2011- Jane Norman collapses into administration putting 1,600 jobs at risk. Retailer closed its 90 UK stores over the weekend after it failed to find a buyer for the business. Zolfo Cooper have been appointed as administrators. At the time of writing, website had not been updated with information on how the company intends to handle online orders

On 24th June 2011 - Edinburgh Woollen Mill has entered the race to buy womenswear chain Jane Norman

On 23rd June 2011 - Debenhams bid to acquire the stock and brand Jane Norman. Debenhams wants to keep the profitable Jane Norman concessions trading in its department stores, but has no interest in its 91 high-street stores

On 20th June 2011 - Private equity firms Sun Capital Partners and Better Capital entered rescue talks

On 17th June 2011 - The management team behind Aurora Fashions emerged as an interested party to acquire beleaguered Jane Norman

On 8th June – Jane Norman managing director Ian Findlay stepped down

On 7th June 2011 - Jane Norman was put up for sale

On 15th April 2011 – Jane Norman kicked off a radical overhaul of its product and image to target a younger, trend-savvy shopper

On 1st March 2011 -Jane Norman veteran Saj Shah takes early retirement

On 6th April 2010 - Jane Norman approached Aurora non-executive president Stewart Binnie to become its new chairman

On 10th Jan 2010 - Jane Norman’s lenders are to take over the business and restructure its debts of almost £136m

On 1st May 2010 – The company drafted in accountancy company PricewaterhouseCoopers (PwC) to assess the "operational efficiencies" of the business, three months after one of its major shareholders, Baugur, went into administration

On 27th March 2009 - Sandy Goldsborough, the trading director at Jane Norman, left the womenswear retailer after just six months in the role

Financial Health for Year Ended 27th March 2010

Total sales for the period ended 27 March 2010 were £144.1m (2009 £148.8m). The gross profit margin was 56% (2009: 56%), resulting in gross profit for the period of £80.0m, a decrease of £3.0m on the prior period. Administrative costs decreased from £72.0m to £70.0m mainly as a result of the reduction in costs for newly-opened stores, and reduction in head office costs. Administrative costs amounted to 48% of sales (2009: 48%).

As a result, operating profit for the period under review was £10.6m (2009 £11.1m). EBITDA was £15.4m (2009 £16.2m) and EBITDA margin was 11% (2009: 11%).

Want to read more? Subscribe to SnapShop to download Jane Norman’s latest accounts or register online to receive information packed newsletter for 3 months.

Retailer Profile – Jane Norman

Founded in 1952, Jane Norman is a womenswear retailer with over 170 stores/concessions in the UK and has a staff of over 1,600. It is positioned in the middle sector of the clothing/footwear market, with focus on young fashion. The Jane Norman target customer is typically aged between 16 and 25 and the company is most strongly associated with dressy fashion (weekend, pub and clubwear).

It was a private limited company following a management buyout backed by Baugur in 2005. Jane Norman did not appear to have been affected by the administration of Baugur.

In May 2009 Jane Norman drafted in accountancy company PricewaterhouseCoopers (PwC) to assess the "operational efficiencies" of the business. It was announced in June 2011 that Jane Norman had been put up for sale.

In June 2011 it was announced that Jane Norman had entered administration, and 90 stores had been closed. Click here to view retailer’s profile on SnapShop

According to a recent report by Deloitte, the first quarter of 2011 has witnessed the highest number of retail administrations in two years with nearly 20 administrations recorded on SnapShop in Q1. Do you need to keep up-to-date with these trends and statistics? SnapShop, being an information tool, records just such information: retailers’ financial health, daily updated news, number of stores, head office details on over 2300 retailers and SnapShop News Alerts will keep you up to date with news about retailer administrations.

|

|

|

|

Retail Store Closures – May – June 2011 |

| |

Posted At: 24 June 2011 15:46 PM

Related Categories: Retail, Retail Property, Retailers, Store Closures |

| |

• On 22nd June 2011 – Comet announced to close 17 underperforming stores and no new stores are planned. Retailer said margins were hit in a highly promotional trading environment in the UK and lost market share

• On 21st June 2011 - Life & Style reported closing 22 of it 150 stores and making 274 people redundant after it fell into administration earlier in June

• On 17th June 2011 – Haldanes closed all its 23 shops after the owners filed an administration order. It is expected four will reopen

• On 25th May 2011- The administrators of Focus DIY are expected to announce the closure of more than 120 stores

• On 20th May 2011- Firkins Bakery closed its production bakery in Blacklake, West Bromwich, with more than 40 workers made redundant

• On 18th May 2011- Mothercare plans to close around 110 of its high street stores by March 2013, after seeing underlying UK profits slump by 70% in the last year

For more information and up-to-date news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months

According to LDC, in the last two years retail store closures have resulted in a tripling of the shop vacancy rate to 14.5% and the number of profit warnings from retailers has increase tenfold. This could be attributed to a number of factors like significant growth of out of town retail at a rate greater than that of in town, increasing internet sales, growth and expansion of supermarkets etc.

Network Rail, however, is presenting a very different picture, with retail sales increases at its stations outstripping the high street. Whilst overall retail sales from January to March 2011 dropped 0.8% YoY, trading at train stations across the UK rose 5.17% with London stations outperforming other stations during the quarter.

At the same time it was relieving to see that Harrow council hopes to mask the effects of economic decline by creating London’s first high-tech “fake shop”, turning a boarded-up property into what appears to be a florist’s in an effort to attract independent retailers to the high street as one in five shops in north Harrow is vacant.

With the changing nature of UK high street there is a need to rethink the futures of these empty shops. To read more about FSP’s approach to attracting town centre and shopping centre occupiers, click here

Related Blogs:

Empty Shops level – Q1 2011

Empty Shops level rises to all-time high

Squeezed Middle

Retail Administrations 2010

|

|

|

|

Retail Spotlight - Haldanes in Administration |

| |

Posted At: 20 June 2011 17:10 PM

Related Categories: Administrations, Retail, Store Closures |

| |

Following the recent news that Haldanes has collapsed into administration; we bring to you highlights of the administration:

On 9th June 2011 - Haldanes filed for an administration order, with the owners blaming the Co-op for its woes. In a statement, chief executive Arthur Harris assured that Haldanes Stores and Ruston Retail are the holding companies for the stores’ groups, and all the stores are unaffected and will remain open

On 20th June 2011 - The grocer has closed all its 23 shops after the owners filed an administration order. It is expected four will reopen

History of Events

On 6th November 2009 – Starting with four former Co-operative sites in Scotland, Haldanes Stores set up a new nationwide chain of supermarkets

On 17th November 2009 - The Company, announced the opening of its first store at Prestonpans, took over four ex-Somerfield outlets in Scotland and had plans to expand the chain

On 2nd December 2009 – Haldanes announced the acquisition of 13 new outlets across the UK purchased from Co-operative Group following its £1.6 billion Somerfield buyout

On 15th Jan 2010 - Haldanes acquired a further eight stores from the Co-operative Group, with the transfer of 245 staff

On 27th Jan 2011 – Haldanes announced the launch of a new fascia, “Ugo”, which comprised 20 of the Netto stores Asda had to sell off as part of its £778m acquisition

On 12th May 2011 – Legal actions broke out between the Co-operative Group and Haldanes over the former Somerfield stores bought from the Co-op in early 2010

For more information and up-to-date news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

Retailer Profile – Haldanes

Haldanes Stores specialise in fresh, locally sourced products, has 23 supermarkets located throughout Scotland and England and employs around 600 people across the UK

It was announced in June 2011 that Haldanes Stores Limited and Ruston Retail Limited had filed for an administration order. All stores have been closed, although it is expected that four will reopen.

Could the business have been rescued? Let us know what you think…

|

|

|

|

Retail Spotlight –V8 Gourmet enters administration |

| |

Posted At: 20 June 2011 10:10 AM

Related Categories: Administrations, Retailers, Store Closures |

| |

Following the recent news that V8 Gourmet has collapsed into administration; we reviewed and updated the retailer records for group’s holdings on SnapShop. Below is a summary of the retailer profile and highlights of the administration:

In January 2009 - Gourmet Restaurants Group - the firm behind The Bombay Bicycle Club and the Tiffinbites and Vama Indian Restaurant chains was bought by entrepreneur Anoup Treon

In August 2009- Celebrity Big Brother winner Shilpa Shetty announced a 33% stake in V8 Gourmet Group.

In Dec 2010 –Group instructed property agent Cedar Dean Gilmarc to sell 10 Bombay Bicycle Club outlets

In March 2011 - V8 Gourmet entered emergency talks with its lenders and investors after HM Revenue & Customs petitioned for it to be wound-up after falling behind on its debt repayments to Indian bank ICICI

In May 2011 - The Bombay Bicycle Club and Tiffinbites curry houses have been rescued from the brink of collapse for the second time in under three years

In June 2011 – Group collapsed into administration again despite receiving last minute backing from new investors. Investment group Calleon stepped forward to take on the business’ debt at the last minute, but despite best efforts. Joint administrators Nimish Patel and Finbarr O’Connell of Re10 are continuing to trade the business as usual. At present no changes are to be made, and administrators are working hard to secure the jobs of all 264 employees.

For more information and up-to-date news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

Retailer Profile – V8 Gourmet

In January 2009 it was rumoured that Gourmet Restaurant Group were about to go into administration, however the group was bought by entrepreneur Anoup Treon in the same month. Gourmet Restaurant Group was rebranded V8 Gourmet Ltd.

The group, which operates 17 restaurant and takeaway sites across the Bombay Bicycle Club (BBC) and Tiffinbites brands, as well as catering arm Khana by Vama, Silk.

According to the most recent accounts filed with Companies House, the group made a pre-tax loss of £2.6m in 2009, with sales of £10.4m. It is thought V8 Gourmet was making a loss of £200k a month. V8 Gourmet Ltd entered administration again in June 2011.

Retailer Profile – Tiffinbites

Tiffinbites is an Indian restaurant offering faster, healthier dining with 4 outlets and concessions in Harrods & Selfridges across London. Tiffinbites and the Tiffin tin designs it uses for its takeaway service are trademarks of V8 Gourmet Ltd. It was announced in June 2011 that V8 Gourmet Ltd had entered administration. All outlets will continue to trade as normal.

Retailer Profile – Bombay Bicycle Club

The first Bombay Bicycle Club restaurant opened in Clapham 20 years ago and serves Indian cuisine. There are two restaurants in Balham and Holland Park and 15 home delivery kitchens which take orders via telephone or over the internet and deliver to set area in London. In July 2008, Bombay Bicycle Club became part of the Gourmet Restaurants group having been sold by Clapham House Group in July 2008.

It was announced in December 2010 that V8 Gourmet have instructed Cedar Dean Gilmarc to dispose of 10 outlets predominantly in London. In June 2011 that V8 Gourmet Ltd had entered administration. All outlets will trade as normal.

Related Blogs:

Life & Style in administration

Georgina Goodman goes into administration

Peter Werth & Pink Soda for sale

Focus in Administration – Updated

|

|

|

|

Retail Spotlight – Life & Style collapsed into administration |

| |

Posted At: 10 June 2011 15:17 PM

Related Categories: Administrations, Retailers, Store Closures |

| |

Following the recent news that the fashion and homewares retailer Life & Style has collapsed into administration; we reviewed and updated the retailer record on SnapShop. Below is a summary of the retailer profile and highlights of the administration:

6/04/2010 – Life & Style Retail Limited was formed when Ethel Austin (comprising of 90 stores), the value chain and Au Naturale, was sold back to Elaine McPherson for a second time for an undisclosed amount by administrator MCR

19/05/2010 - Elaine McPherson, the former owner of Ethel Austin, has secured an injection of funds to launch Life & Style

04/01/2011 – Retailer signed a 10 year lease for an for an 8,700sq ft unit in Gallions Reach shopping park in Beckton, East London

08/01/2011 – Retailer reported to be on the brink of collapse after just over a year in existence

10/06/2011- Life & Style collapsed into administration and SKG Capital (headed up by entrepreneur Chris Althorp-Gormlay), the private equity business, is thought to be the frontrunner to acquire the retailer. Its banks appointed RSM Tenon as administrators. Loss of jobs (if any) was not clear.

21/06/2011 – Life & Style is closing 22 of it 150 stores and making 274 people redundant as administrators RSM Tenon continue talks with potential buyers.

For more information and up-to-date news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

Retailer Profile – Life & Style

Life & Style was born from the ashes of Ethel Austin and Au Naturale, when the value chains assets were rescued from administration by Elaine McPherson in March 2010. It is a fashion and homewares chain which consists of over 90 former Ethel Austin stores. McPherson wanted to grow the business to 200 stores over the next two years.

It was positioned in the Lower Middle/Value sector of the market with a focus on Classic Safe fashion.

Related Blogs:

Georgina Goodman goes into administration

Peter Werth & Pink Soda for sale

Focus in Administration - Updated

|

|

|

|

Retail Spotlight – Georgina Goodman goes into administration |

| |

Posted At: 08 June 2011 10:00 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following the recent news that premium footwear retailer Georgina Goodman has collapsed into administration; we reviewed and updated the retailer record on SnapShop. Below is a summary of the retailer profile and highlights of the administration:

On 21/01/2010 – Retailer secured a £4m private equity investment from Core Capital to fund the expansion of its London-based footwear business.

On 02/02/2010 - Following investment from Core Capital Georgina Goodman announced expansion plans and said that the investment will also be used to broaden the lower-priced end of the range.

On 07/06/2011 – Georgina Goodman hit the buffers for reasons unclear. Restructuring firm Hilco was appointed on June 2 to handle the sale of the company, which is understood to be underway with an undisclosed buyer. The company’s Shepherd Street store and website have already closed while the Old Bond Street shop remains open.

For more information and up-to-date news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

Retailer Profile - Georgina Goodman

Georgina Goodman is a footwear retailer which had two London stores (Shepherd Street and Old Bond Street), as well as a transactional website. Product is aimed at the upper middle of the market with a focus on Assured Individual fashion.

As of June 2011 it was announced that Georgina Goodman had entered administration, for reasons that are unclear. One store and the website have been closed.

Information Displayed on Website – “By Order of K Provan and M Fry, Joint Administrators of Georgina Goodman Ltd. At this moment in time, you can no longer place orders from this website.”

However, it is unclear how company aims to fulfil orders already placed and loss of jobs (if any)

|

|

|

|

Retail Spotlight - Blue Inc |

| |

Posted At: 13 April 2011 00:29 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following the recent news that Blue Inc has taken on 46 The Officers Club stores after the latter fell into administration in March 2011 FSP has reviewed and updated the retailer records on SnapShop . Below is a summary of the retailer profiles and highlights of the acquisition:

• On 29th March 2011 – The Officers Club fell into administration for the second time in just over two years, leaving hundreds of jobs at risk.

• On 29th March 2011 - Blue Inc bought 46 stores out of administration, in a deal thought to be worth about £5m. The deal was announced, the same day The Officers Club appointed Grant Thornton as its administrator.

• On 31st March 2011 – It was announced that stores bought are expected to add between £25 and £30m of sales to Blue Inc’s turnover, bringing its revenues up to about £80m.

Retailer Profile - Blue Inc.

Established in 1912, Blue Inc. is a menswear retailer with over 140 stores in the UK with annualised sales of £80m. It is positioned in the Lower Middle sector of the market with a focus on Young Safe fashion, and brands stocked include Kickers, Base and Ben Sherman. 80% of store offering is own brand, and Blue Inc Woman is available in selected stores. Blue Inc is the trading name of A Levey & Son Ltd which was bought by Marlow Retail in January 2006. In November 2010 it was announced that the retailer is seeking retail units with a sales area of 2,500 to 4,000 sq ft in cities and smaller to mid-sized towns.

Retailer Profile - The Officers Club

The Officers Club was established in 1998 and has since grown to become one of the largest independent menswear retailers in the UK, with around 110 branches (before administration) nationwide. The offering was situated in the Lower Middle/Value sector of the markets with a focus on Family Safe fashions; however, a refocus of the business in the last 5 years now sees it targeting the "fashion savvy males” in the 16-25 year-old market.

More information and analysis is available to SnapShop Members. You can subscribe to SnapShop online at any time.

|

|

|

|

Retail Administrations - 2010 |

| |

Posted At: 21 March 2011 17:00 PM

Related Categories: Administrations, Retail, Store Closures |

| |

A comparison of the retail administrations in 2010 with those in 2009 has confirmed the view that there has been a steep fall in number of companies filing for administration in 2010. There were 32 retail administrations in 2010, versus 72 in the comparable period of 2009.

The retail industry showed healthy signs of recovery in 2010, with this dramatic drop of 44% in the number of companies falling into administration.

Administrations reported in previous issues of SnapShop Monthly summarised below:

· November 2010 - Speciality Retail Group went into administration this month, wiping out three high street names in the process: Suits You, Racing Green and Youngs Hire

· October 2010 - Fifi and Ally is the only reported retail casualty

· August 2010 - Two retailers hit the buffers with Confetti and Asco Supermarket, turning up its toes completely and going into liquidation

· July 2010 - Out of Town Restaurant Group hit the buffers, following allegations of fraud

· June 2010 - Two administrations, but in true Phoenix fashion, both Antler and JAG Communications resurrected through pre-pack

· May 2010 - Two administrations were Faith and Lab Sport

· April 2010 - Two Administrations, in the form of Envy and Saltrock

· March 2010 - Three Administrations which were Irish bookseller Hughes & Hughes, Jean Scene Ireland Ltd and Norfolk-based Riva Shoes

· February 2010 - Retail Administrations include Diamonds & Pearls, Designer Room, Ethel Austin and sister Au Naturale and the Fads, Textyle World and Leveys brands, owned by Divalimit

· January 2010 - six retail administrations, including Adams, D2, Wesley Owen, Natural Kitchen, Ellie Louise and Happit; three of these appear to have been pre-pack administrations, while the others, aside from Adams, have also been rescued.

These statistics tally up with the views of chief executives of Debenhams, New Look and Kingfisher who have predicted that the UK will not suffer from a double dip recession. All three give reasons for hope, with international, multichannel and product innovation hotspots in the industry.

For up-to-date information on store closures/retail administrations please subscribe to SnapShop.

|

|

|

|

|